Posts

-

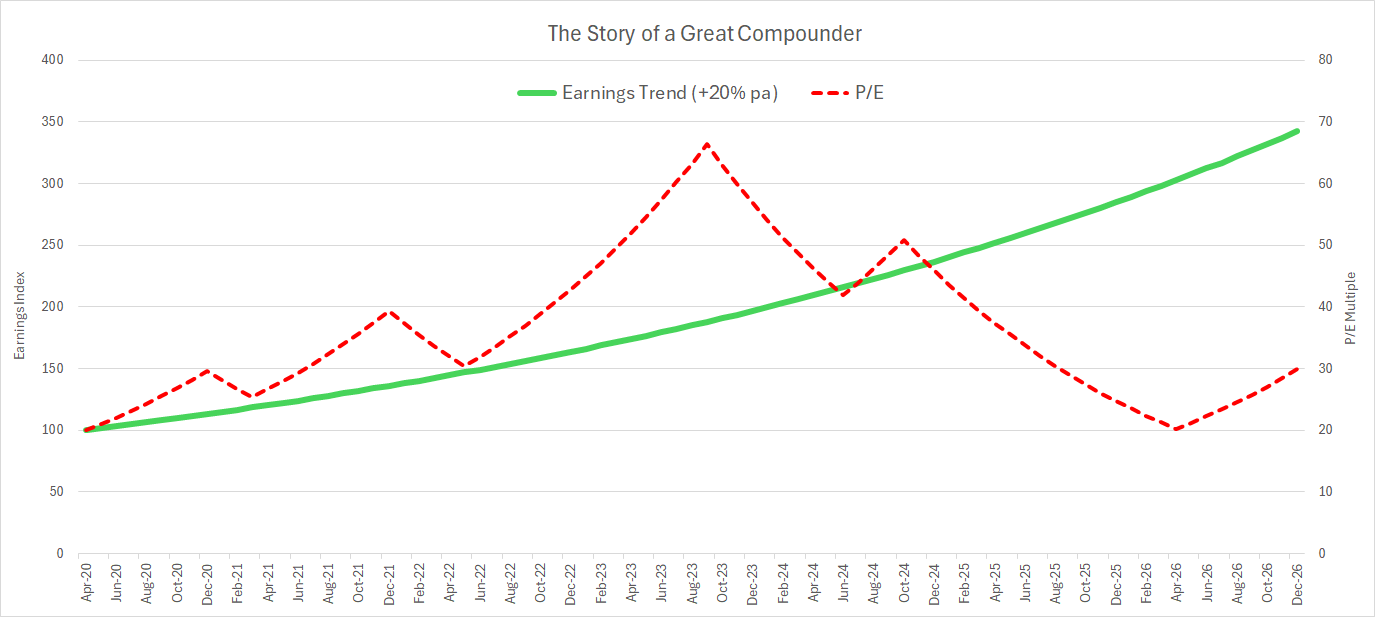

The Cost of Selling Too Soon: How Value Investors Outsmart Themselves

Value investing was built on discipline: buy cheap, insist on a margin of safety, and sell when the market gets carried away. For multiple generations of value investors, that mindset worked beautifully. It kept emotions in check, avoided overpaying, and turned constant volatility into plentiful opportunity. But in the 21st century the most disciplined value

-

[DRAFT] Ways to Make Money in the Stock Market

There are many ways to make money in the stock market and, if you are fixed on trying to do it, it pays to know what ways you will use and what their strengths and weaknesses are. I will group the various approaches into two buckets based on their primary driver: In the bucket of

-

Fama-French 5-Factor Model: the academic breakthrough

What is it? The Fama-French 5-Factor Model is an attempt to explain what drives stock returns. Eugene Fama and Kenneth French first introduced the 3-factor version in the 1990s – adding size and value to the basic market factor – and then expanded it in 2015 by adding two more: profitability and investment. So now

-

Shareholder Yield: looking beyond just dividends

There’s more than one way to return money to shareholders. Dividends get most of the spotlight, but they’re just one piece of the puzzle. That’s where Shareholder Yield comes in – a broader way to measure what companies are really giving back to their owners. The term was popularized by Meb Faber, an investor and

-

The Acquirer’s Multiple: stripped-down value investing

The Acquirer’s Multiple is what you get when you take value investing, remove the bells and whistles, and focus on just one thing: price. Specifically, how cheap a company is relative to the cash it earns. It was popularized by Tobias Carlisle, a value investor and author of The Acquirer’s Multiple (2017). He built on

-

The Magic Formula: a value investor’s take

Back in 2005, Joel Greenblatt published The Little Book That Beats the Market. It’s slim, easy book that makes a big claim: anyone – even those without a finance background – could beat the market by following a simple set of rules. He named the system, and it is now widely known as, the Magic