There are many ways to make money in the stock market and, if you are fixed on trying to do it, it pays to know what ways you will use and what their strengths and weaknesses are.

I will group the various approaches into two buckets based on their primary driver:

- making money from other participants, and

- making money from the underlying businesses

In the bucket of “making money from other participants” we have:

- High-frequency trading

- Short term moves trading – medalion

- Market sentiment trading – Soros, Druckenmiller

- Momentum trading – 12m

- Growth investing – as a subset of momentum – often disconnected from fundamentals, chasing trends over focusing on the growth moat

- Short-selling

- Hedging

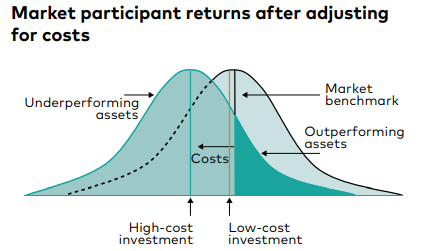

Key characteristic of this bucket are the usual holding period of up to a year and its zero-sum nature. This means that for you to make money, in excess of the general market movement (beta), you have to outsmart another market participant. And to make it harder, because of the frictional costs of investing, it’s not enough to beat 50% of the other investors at a zero-sum game but rather you have to get to the top 40 or 30%. Or, putting this concept on a graph, to win in the zero-sum part of investing you have to be in the dark green part of the graph below, while competing with other, oftentimes skilled and focussed, investors.

Half and half:

- Cyclicals’ investing

- Deep value / Acquirer’s Multiple investing – monetising despair – reversion to the mean plus liquidation value

And in the bucket of “making money from the underlying businesses”, with the desired holding period of “forever”, or at least multi-year compounding, we have:

- Catalyst investing

- Activist investing – young Buffett

- Turnarounds

- Net Nets investing – liquidation value

- Leveraged Buy-outs (LBOs)

- Buffett’s “wonderful company at a fair price” – moat investing / Magic Formula – monetising the skill of identifying a genuine and enduring competitive advantage

- Dividend investing / Shareholder Yield – monetising managements’ shareholder-focus

- Value Creation Score investing – monetising time arbitrage

- Index investing (in the context of long-term investing into the key large indices – S&P, MSCI World, 60/40) – dollar-cost averaging – monetising risk avoidance